Schaeffler AG, Herzogenaurach (ISIN DE000SHA0159, WKN SHA015) has decided to adjust its full year 2018 guidance for the Schaeffler Group as a whole and for its Automotive OEM and Automotive Aftermarket divisions. Against the background of increasing market volatility in the global automotive business (WLTP, trade conflicts), the adjustment of the full year 2018 Group guidance is mainly triggered by a further deterioration of market conditions in the company’s Automotive OEM business in China. Furthermore, weaker-than-expected third-quarter sales performance in its Automotive Aftermarket division contributed to the guidance change.

Based on preliminary figures, the Schaeffler Group generated revenues of EUR 3,521 million (prior year: EUR 3,434 million) and third-quarter earnings before financial result and income taxes (EBIT) of EUR 376 million (prior year: EUR 416 million). In the third quarter, the Group’s revenues grew 3.7 per cent at constant currency. On this basis, revenues for the first nine months of the year were EUR 10,714 million (prior year: EUR 10,480 million), corresponding to growth of 5.1 per cent at constant currency.

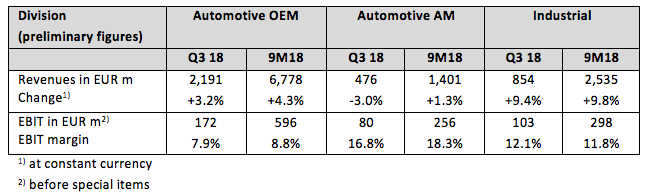

The Group’s EBIT before special items in the third quarter 2018 was EUR 355 million (prior year EUR 416 million) and EUR 1,150 million (prior year: EUR 1,196 million) for the first nine month, corresponding to an EBIT margin before special items in the third quarter of 10.1 per cent (prior year 12.1 %) and of 10.7 per cent (prior year: 11.4 per cent) for the first nine months. The Schaeffler Group’s free cash flow before inflows and outflows for M&A activities reached EUR 201 million (prior year EUR 333 million) and EUR 127 million in the first nine months, which is attributable primarily to lower earnings quality and the higher level of capital tied up in inventories. The third-quarter and nine-month results for the Group’s three divisions are as follows:

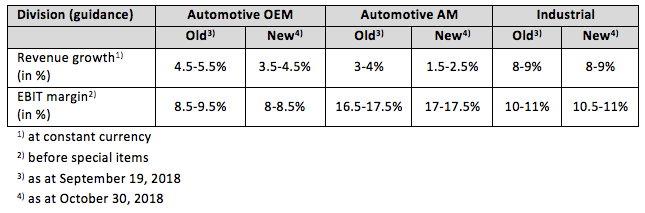

On the basis of preliminary figures, Schaeffler is now guiding for 2018 full-year revenue growth of 4 to 5 per cent at constant currency (previously 5 to 6 per cent), an EBIT margin before special items of 9.5 to 10.5 per cent (previously 10.5 to 11.5 per cent), and free cash flow before inflows and outflows for M&A activities of approximately EUR 300 million (previously approximately EUR 450 million). The guidance for each of the divisions now is as follows:

Forward-looking statements and projections

Certain statements in this press release are forward-looking statements. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial consequences of the plans and events described herein. No one undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place any undue reliance on forward-looking statements which speak only as of the date of this press release. Statements contained in this press release regarding past trends or events should not be taken as representation that such trends or events will continue in the future. The cautionary statements set out above should be considered in connection with any subsequent written or oral forward-looking statements that Schaeffler, or persons acting on its behalf, may issue.

Contact

Thorsten Möllmann, Senior Vice President Global Communications & Branding

Schaeffler AG

Herzogenaurach, Germany

Phone +49 9132 82-5000

Email: [email protected]